For existing SMSFs that get transferred to Selfmade, we'll first do a check on whether your SMSF investments can be moved to our platform.

For new SMSFs established through Selfmade, our platform uses Macquarie Bank’s leading Cash Management and Online Trading products to help you invest your super. This means you are restricted to the investment options available through Macquarie when you set up your SMSF with Selfmade. However, if you're interested in another type of investment, please contact us.

These are some of the main investment options available with Selfmade:

- Australian shares

- Exchange traded funds (ETFs)

- mFunds

- Warrants

- Cash and term deposits.

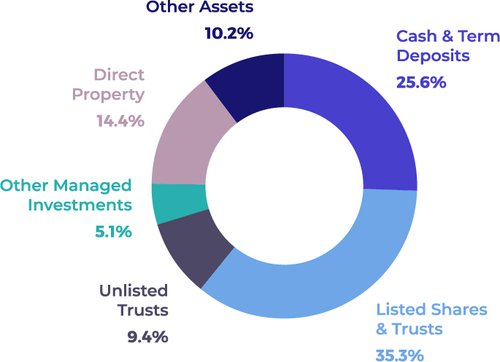

The Selfmade platform supports investment in assets that cover all of the most popular investment classes for SMSF.