Financial Services Guide

The financial services referred to in this guide are offered by

Selfmade Advice Services Pty Ltd

ACN: 641 233 445

Level 2, 100 Collins Street, Melbourne, VIC 3000

Phone: 1300 151 381

Selfmade Advice Services Pty Ltd (“We”, “us” or “our”) is a Corporate Authorised Representative of C2 Financial Services Pty Ltd (AFSL: 502171). Any advice provided by representatives of Selfmade Advice Services Pty Ltd is General Advice or Factual Information (No Advice) only.

This guide contains important information about

- The financial services you may receive from us.

- Information we need from you.

- Relationships or associations that exist which might influence us in providing the financial services to you.

- The cost of our financial services and how we are remunerated.

- What to do if you have a complaint about our services.

Types of financial services you may receive

As authorised representative of the AFS Licensee, we are authorised to offer the following financial services:

- provide general financial product advice in respect of: deposit and payment products limited to: basic deposit products, securities, interests in managed investments schemes (including investor directed portfolio services), risk insurance and superannuation; and

- deal in a financial product by applying for, acquiring, varying or disposing of a financial product on behalf of another person, in respect of: basic deposit products, securities, interests in managed investments schemes (including investor directed portfolio services), risk insurance and superannuation and superannuation;

To retail and wholesale clients.

We may choose not to provide certain products or services, even if we are authorised to provide them.

Selfmade Advice Services Pty Ltd is not authorised to provide Personal Advice; that is, we do not advise you as to whether a financial product, service or strategy is appropriate for you. Advice provided by Selfmade Advice Services Pty Ltd does not take into account your personal circumstances, needs and objectives in relation to whether you should invest or utilise particular financial products or services. The decision as to whether you should invest or utilise a particular financial product or service is solely made by you.

Information we need from you

We expect that you will provide us with accurate information that we request to be able to efficiently and accurately deliver our financial services to you.

As a financial service provider, we have an obligation under the Anti-Money Laundering and Counter Terrorism Finance Act to verify your identity and the source of any funds. This means that we will ask you to present identification documents such as passports and driver’s license. We will also retain copies of this information. We assure you that this information will be held securely.

Possible consequences of not providing this information

You are of course at liberty to decline to provide some or all of this information, but if you do not provide it, we may not be able to:

- Provide you with the product or service you want;

- Manage or administer your product or service;

- Verify your identity, which may not protect you against fraud.

Relationships or associations that exist which might influence us in providing the financial services to you

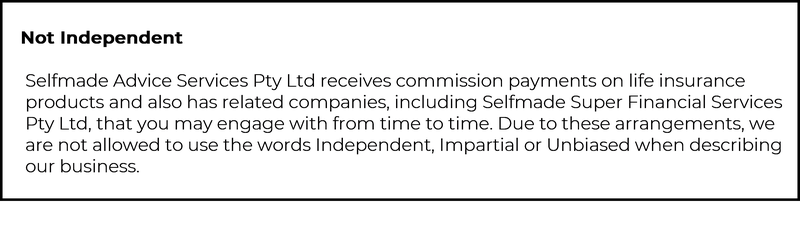

Selfmade Advice Services Pty Ltd is 100% owned by Selfmade Super Financial Services Pty Ltd. Selfmade Super Financial Services Pty Ltd provides SMSF administration and taxation services.

The cost of our financial services and how we are remunerated

Selfmade Advice Services Pty Ltd is remunerated through the fees and commissions that you are charged. To assist you in making an informed decision, we will disclose to you any fees and/or commissions payable before providing you with our financial services.

Alternative remuneration (Non-monetary benefits)

From time to time Selfmade Advice Services Pty Ltd may receive non-monetary benefits from product providers. This can range from small benefits such as movie or sporting event tickets to more valuable benefits such as sponsorship to attended conferences.

If the value of any of these benefits exceeds $300 it will be recorded in the Alternative Remuneration Register. A register will be maintained by Selfmade Advice Services Pty Ltd for any benefits received by them that exceed $300.

Information we maintain on file and for how long

We need to hold all information you give us for a period of 7 years. You can view information held by making a request.

Compensation arrangements in place and compliant

It should be noted that Selfmade Advice Services Pty Ltd is covered by Professional Indemnity Insurance of C2 Financial Services (licensee) for the financial services that we provide. We understand that it is adequate to meet our requirements and that of C2 Financial Services as per the provisions of RG126.

What should you do if you have a complaint?

We are committed to providing quality advice to our clients. This commitment extends to providing accessible complaint resolution mechanisms for our clients. If you have any complaint about the service provided to you, you should take the following steps:

- Contact Selfmade Advice Services Pty Ltd immediately on 1300 151 381.

- If your complaint is not satisfactorily resolved within 7 days please contact C2 Financial Services Pty Ltd within 7 days via phone no’s 02 8098 0300 or put it in writing and send to PO Box R1373 Royal Exchange Sydney NSW 1225.

If we cannot reach a satisfactory resolution within a further 45 days you can send a complaint to AFCA (Australia Financial Complaints Authority) via their website at www.afca.org.au. Their free call number is 1800 931 678. The Australian Securities and Investments Commission, (ASIC), also has a free call info line on 1300 300 630 which you may use to make a complaint or obtain information about your rights.

Updated: 1 July 2021